Money printing by banks and governments has generated a great deal of inflation but looking beyond that, real cost increases have driven up many prices. Monetary policy will not affect the real cost increases driving a substantial portion of what we term “inflation”.

Energy cost increases cause all prices to rise as energy is the primary resource. Energy is an increasingly more expensive commodity however as we deplete the richest resources and move on to less dense and smaller sources.

In effect, it takes energy to harvest energy. In the early days of oil, the richest virgin fields sometimes returned 100 barrels of oil for every barrel of oil equivalent used in finding, drilling and pumping the field. Now, in the 2020s, the world average Energy Returned on Energy Invested (EROI) is around 17:1.

Similarly, all of the best sites for hydro electric dams have been developed and current projects work with smaller, less reliable water flows. More investment for lower returns means higher production costs.

Here is a video link which describes the critical social-economic metric of EROI:

https://www.youtube.com/watch?v=2AwIgeyPtJY

Why Gas Prices Have Gone Up

Conventional Oil Fields

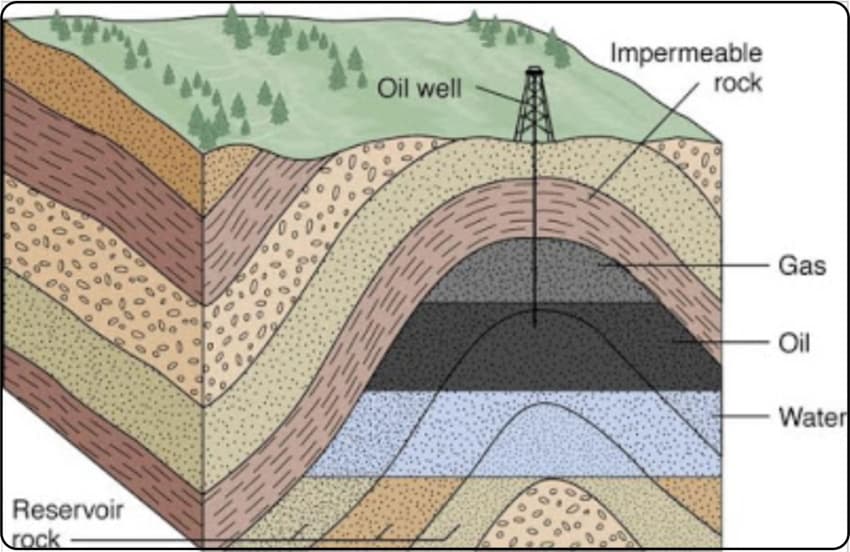

In the days of early oil where large, easily accessible virgin fields supplied seemingly unlimited cheap energy, all that was required was to stick a pipe down into a pool or reservoir* of oil and either let it gush out or pump it out. These conventional fields could maintain a constant output for decades before declining at perhaps a rate of 3% to 5% annually. The EROI (Energy Returned on Energy Invested, approached 100:1 for the early large well.

- Reservoir is a formation of very porous rock filled with oil which can flow fairly easily.

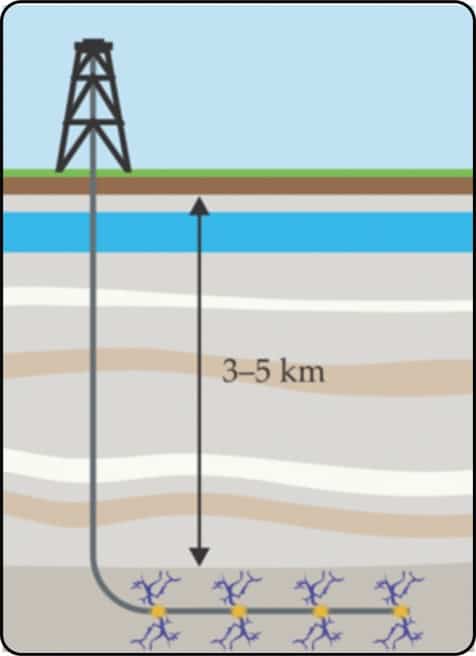

Fracking Oil Wells

The fracking process involves horizontal drilling through a thin layer of oil-bearing rock. Then chemicals and sand are pumped into the formation at enormous pressure, fracturing it, while the sand filters into the cracks holding them open. The oil is then sucked out. The EROI of fracked wells is in the region of 15:1. In other words, for every barrel equivalent of energy used to develop and run the well, 15 barrels are harvested.

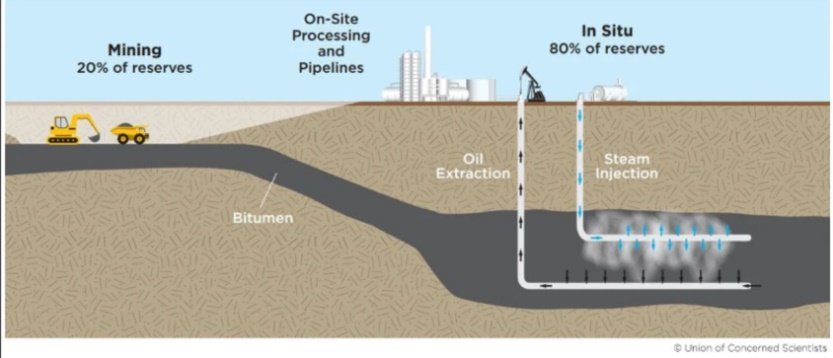

Oil Sands – 2 Methods: Mining and In-Situ

The Canadian Oil Sands are exploited by one of two methods. The first, when the oil-bearing layer of sand is close to the surface, is to dig down to it and truck it off to a processing plant where it is heated, chemically treated and the oil is removed (at least 90%). The tailings are then stored in open pits which are almost as large as the pits where the sand was excavated . The EROI for this method is very low, around 4:1. This does not include the energy required to clean up and return to a somewhat natural state, the huge areas of the pits or the tailing ponds. The second method, In-Situ, is used when the oil sands are buried too deep. In-Situ requires the horizontal drilling of two pipes into the oil layer. One pipe contains steam which heats the sand, allowing the oil to flow down to the lower pipe which sucks it up to the surface.

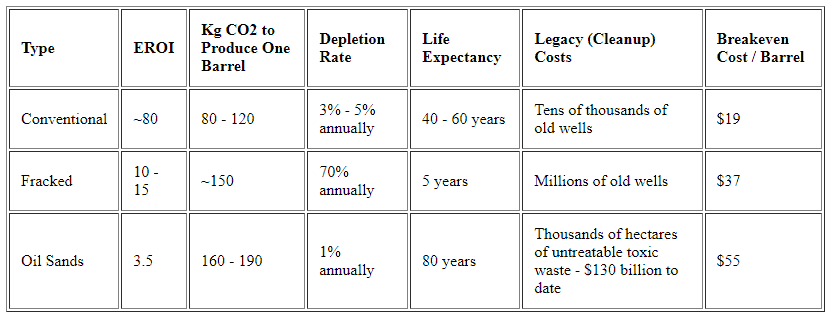

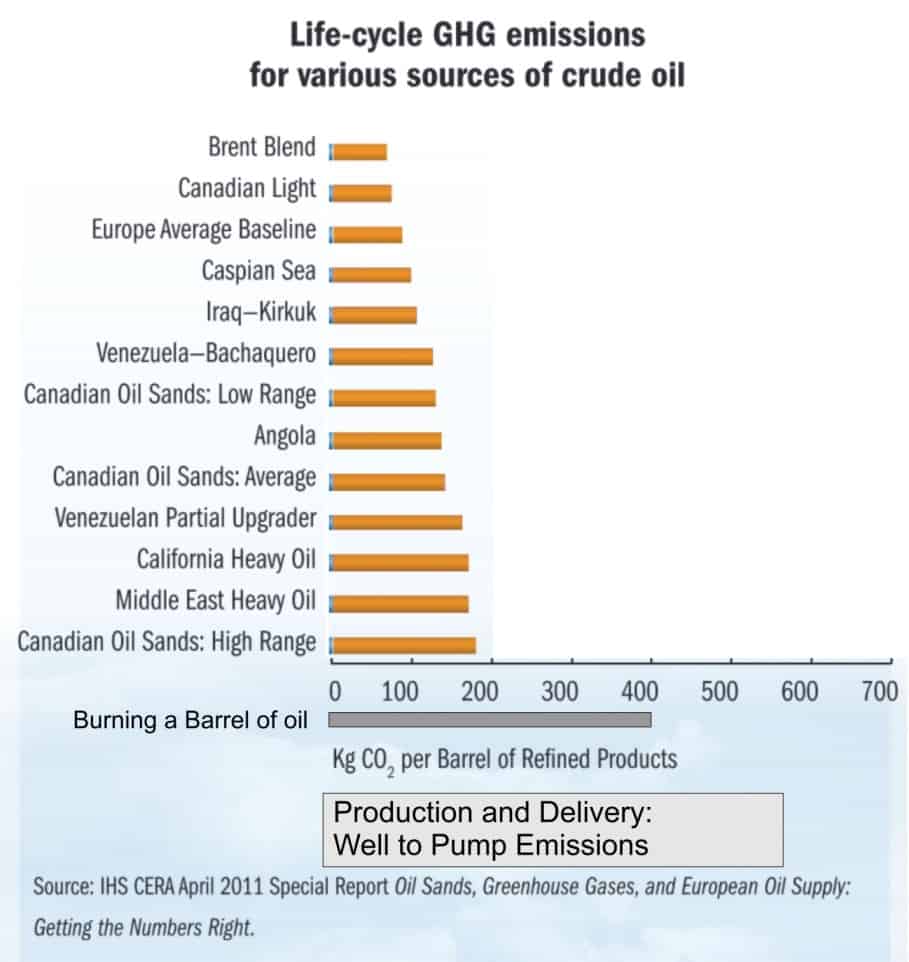

The table below compares the different sources of oil in terms of cost and CO2 emissions per barrel. The more low-grade resources are forced to make up the supply, the more expensive will be the cost of oil and the higher CO2 emissions will go. The sooner we can transition to a renewable-driven, electrified economy, the better.

All oil is not equal and the effort required to produce energy from different fields varies immensely as the CO2/barrel production emissions indicate below. Note that burning a barrel of oil creates approximately 400kg of CO2 emissions.

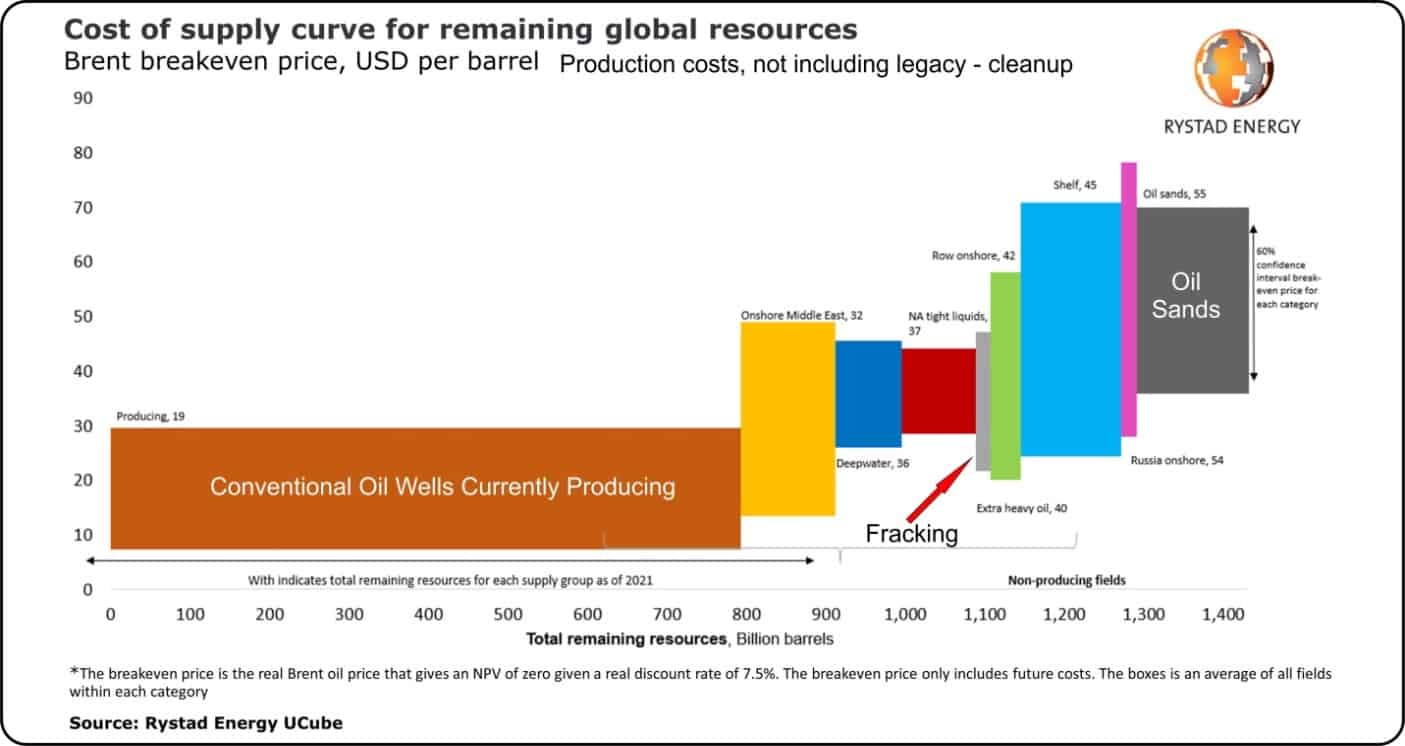

The graph below shows the upfront cost of production in USD per barrel and the size of the world reserves for each major source of oil. The height of each rectangles shows the 60% confidence interval of the breakeven price for that category, while the width shows the number of barrels (in billions) remaining. There is a lot of conventional oil still left and it is the lowest cost source but it can no longer supply all of our current consumption.

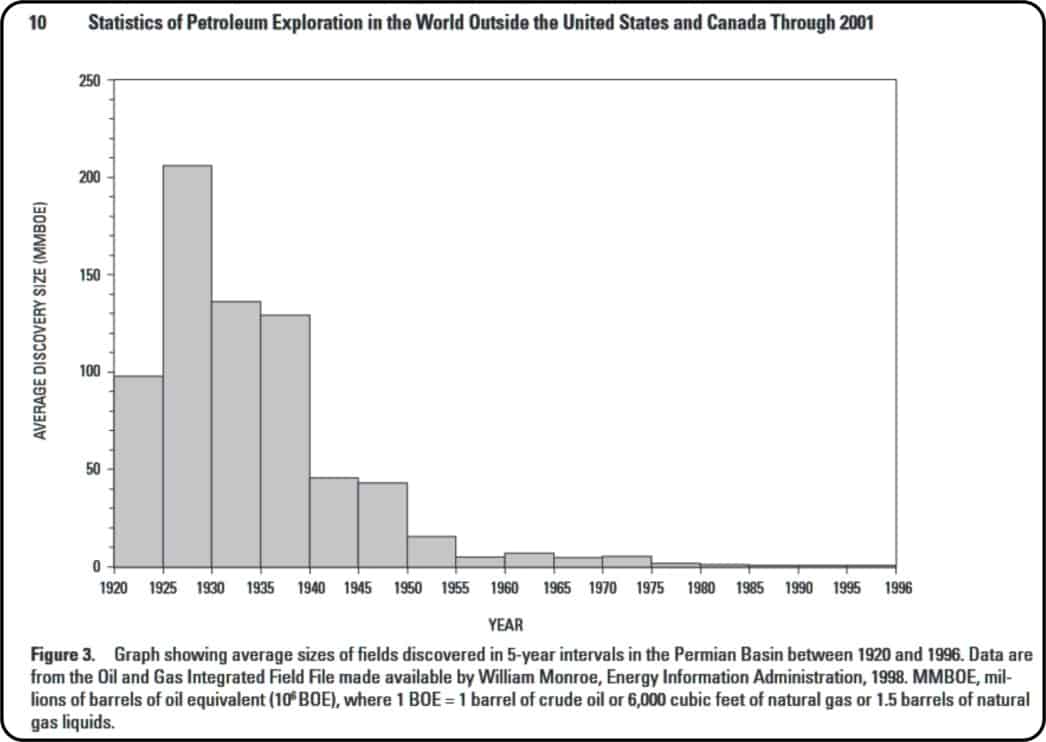

Smaller fields of higher cost oil have to be exploited to satisfy demand. Production from conventional oil fields has peaked and oil finds are becoming smaller and smaller, as the graph below illustrates.

Note the small size of the fracking reserves in the above graph. The US will burn through them very rapidly and then have to switch to even more expensive sources or go to war again to keep its fleet of large personal vehicles on the road for another few years. Isn’t buying an EV and putting solar panels on your roof preferable to those options?

Development of the oil sands requires a huge amount of natural gas which would be much better spent driving gas electrical generating plants. As Robert Hoffman put it, “Using natural gas to produce oil from the oil sands is like spinning gold into lead.”

Average size of oil field discovery over time

Mother Nature isn’t making any more oil, at least none we’ll be able to use in the next 50 million years and we discovered the largest fields two generations ago.

So yes, the real cost of oil is going up which means the cost of gasoline is rising. It may jump this way and that depending on financial crises, international disputes and pandemics but the basic fact remains: the more we use, the more rapidly we will deplete the cheaper sources and the higher the cost will go. CO2 emissions will also rise commensurately with greater dependence on lower EROI sources.

And, of course, energy being the essential enabling component of every single human activity, when energy prices go higher, all prices will go higher. Continual growth and higher demand is making everyone’s life more expensive.

Let your local politicians and your media sources know that.