It is important to identify the causes of inflation because inflation makes a great many people poorer over time. Some causes are real and have to be dealt with individually, or possibly just accepted, while other causes are man-made and deliberate such as printing too much currency. This has been a recurring problem since money was invented. It is driven by greed and also by the unwillingness of leaders to disclose to their citizens exactly what the full costs are of the programs they have implemented. The full cost is then passed on to future generations.

Real World Inflation

In our changing and depleting world, many resources now require more energy and effort to harvest. Ships have to sail further out to sea to find smaller schools of fish. Oil wells have to be drilled deeper to access smaller pools of oil.

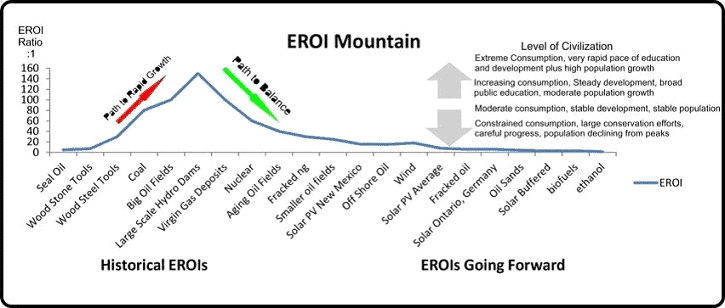

The more energy invested to produce lower returns of energy is best expressed with the ratio developed by Charles Hall which is; Energy Returned on Energy Invested. (EROI) The higher EROI is, the more sophisticated humans societies can become. This is similar to the fertility of fields in agricultural societies. Deep rich soils and large, consistent crops meant that a smaller proportion of the workforce was required to produce food and surplus labour could be applied to manufacturing, education, culture and science.

But once past their prime, declining productivity trends mean resources will simply cost more as the per-unit costs are higher. Higher energy costs are the most pervasive driver of real cost inflation because energy is the primary input of every good and process.

From the middle 1700s onwards humanity has been spending less energy to get more energy. For 200 years, as the fossil fuel bonanza was more aggressively exploited, energy got cheaper. This reached a peak in the period 1930 to 1970 when immense oil fields were brought on line. Since then, energy has become more expensive as the richest resources are in decline and we have started to expend more energy to get less.

Higher real cost driven inflation causes:

- Depletion of resources.

- Declining EROIs are an ongoing source of real inflation. But how much?

- Food prices – energy/climate/paving over prime farmland

- “Orange juice prices soar as poor weather squeezes citrus crops” – Euronews.com “Orange juice prices have risen by 77% because of a drop in production in the main growing regions. There are concerns that orange juice and its fruit will be out of reach for many consumers.“

- Luxuries get more expensive. Outrage over ice cream prices!!

https://www.youtube.com/shorts/qBMSv9A5ouU - If societally fatal climate change, serial extinctions, rampant homelessness and obscene corruption aren’t enough to trigger regime change, possibly high ice cream prices will finally kick our political system into the 21st century.

- Supply chain interruptions cause real cost increases. Red Sea conflict, Covid

- Damage and mitigation costs of increasingly extreme weather.

- Government tax increases for upgraded, more weatherproof infrastructure

- Higher cost of upgraded house building standards

- Higher insurance rates

The only two ways to counteract the decline of our environmental and resource base is through technological advances and the reduction of consumption. Technology is a delaying tactic while the strategy of dramatically reducing the demands we make on our resources is the only way to assure long term sustainability. (read: the viability of sophisticated human societies) Until our consumption is lowered to a level under what the earth can produce, the planet will continue to become less habitable.

In order to make the right decisions, our monetary system has to provide a clear view of real world dynamics by making sure the sticker prices we pay reflect the complete costs of what we are buying. In order to do this the fog of money printing induced inflation has to stop.

Engineered Inflation through Money Printing

Abuse of the mechanism of printed money allows real costs to be obscured and it also allows what is effectively counterfeiting-for-profit.

- Inflation Due to Incompetence/Feckless Politicians

- Government failure to reign in expenses results in deficits supported by printing more money through such devices as bonds

- Government attempts to spur growth by printing money

- Government attempts to drive a change in the economic structure such as transitioning from a consumer economy to a war economy or to a green economy.

- Inflation for Profit

- Demand driven valuation increases which is really inflation but sold as:

- asset inflation, asset enhancement, asset appreciation, the wealth effect – whatever marketing term the usurious money printers and their media shills currently use to try and sell it)

- But a demand driver is needed to make this scam work. For the last 50 years, mass (excessive) immigration has created the demand which has driven up real estate prices in western countries, particularly Canada, Australia, the UK and the USA.

- Demand driven valuation increases which is really inflation but sold as:

- Excess money-printing is counterfeiting and drives wealth from those who produce it to those unproductive people who accumulate it.

- Bank, speculator and developer profits amount to scores of billion $ annually taken from the pockets of every person in the country.

- This is a huge and hidden tax that no one can avoid paying because it inflates the cost of every good and service provided by companies which pay rent or mortgages.

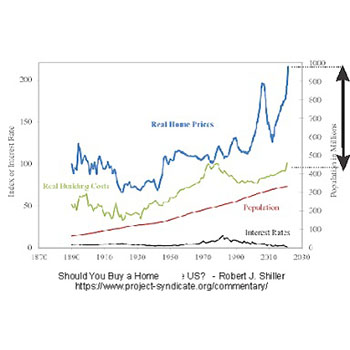

Somewhat like energy, housing and real estate costs are built into every transaction. Higher rents and mortgage payments are the obvious costs paid by almost everyone but businesses also bear real estate costs and these are inevitably added into prices for every good and service.

But investing in production of energy is very different than “investing” in housing prices. The more that is invested in making energy, the lower the price of energy drops (or stabilizes) and the lower the returns on investment are. But the more money that is put into real estate, the higher the prices will go and thus the higher profits will be (as long as there is a demand driver). That is the difference between real productive investment and money printing Ponzi schemes.

Thank you Robert Shiller for putting real costs and inflated prices on the same page! Are you listening media corporations? CBC, explaining complex issues, the welfare of Canadians and love of the land used to be your beat. What happened to you?

Money printing inflation contributes no real wealth yet the elites who promote inflationary policies acquire huge amounts of real wealth.

Higher real costs or Usury -Which is it?

Inflation is something we need to fully understand in order to preserve the progress we have made over the past several centuries. We need to have a clear picture of the real costs of our activities. Money is a marvelous tool to facilitate all manner of transactions but it can be profitized by unscrupulous interests to both distort real costs and obscure their immense growth-driven inflation Ponzi schemes.

When you hear the terms “inflation”, “growth”, “asset appreciation”, “rising prices” in the media, be aware that they can all mean very different things once you look under the hood.

The growth lobby has sold debt and inflated housing prices as a good thing, “the pillar of a strong economy”. But it isn’t; real productive capacity, productivity and well-paid jobs are the foundation of a healthy and strong economy rather than money printing. Growth is not required for progress. On this planet in 2024, it is just the opposite.

Scale of Profit Potential of the Asset Inflation Scam

in $B (in Canada 2020)

Newspaper corporation revenue = $0.94

Defense Industrial revenue = $7.0

Tobacco Industry sales = $19.0

Oil and gas company gross revenue = $94.0

Residential housing asset inflation = $280.0

(valuation of $2.8 trillion 2020, with 10% inflation)

Full and accurate real costs allow good decisions to be made. The sticker price has to be the full price. We need the money system to illuminate real costs and operate for progress, not be manipulated for the profit of a few.

Money is a tool, not a master, and it must be put back in its place rather than being leveraged as a means to enrich a few at the expense of the many.

The challenge of real inflation will now always be with us but it is something we can only effectively deal with after the fog of money printing has been removed.