Condensed from the Jan 31, 2024 presentation to the Canadian Association for the Club of Rome

https://www.youtube.com/watch?v=7R3oMVjAD2M&t=3940s

Calls in the media and from politicians for “growth” have been non-stop for decades even as our social and environmental problems worsen. But who really needs growth? The vast majority of people benefit from progress – making things better – rather than creating a bigger version of a system which is failing them.

Are the media and politicians correct that “the economy” represents the national welfare? Does the economy have to grow to be healthy?

Actually, only part of the commercial economy needs growth – the unproductive and parasitic part, the money economy. The real and productive part of the economy can operate forever without getting any bigger.

But the growth lobby takes cover in the broader business community so it is necessary to break “business” down into identifiable elements to differentiate between public interest and growth-lobby interest. There are 3 types of growth in the economy.

- Dollar Growth (including inflation) – growth of cashflow as represented by GDP

- Population Growth – more people

- Consumption Growth – more material and energy consumed

Most businesses benefit from consumption growth. Many benefit from population growth. Few benefit from inflation and many are hurt by it.

In a non-specific, but humorous nutshell, George Carlin spells this out.

https://www.youtube.com/shorts/xJfl5YhL2XE

The Growth Lobby’s Money Fog

Over 6 decades of OECD high growth, what the Canadian political/media complex has served up has not provided the benefits they imply.

No party would ever be elected running on a platform of larger population, mass immigration, unaffordable housing, higher debt, declining quality of life and cheap labour. In order to get these policies enacted, the growth lobby have to own the media, control the national conversation, bribe politicians and slide their agenda through back channels. They sell it on the premise of bigger must be better.

“It’s the economy stupid”. Actually, political slogans aside, it is how people are doing economically that matters. The size of the economy doesn’t matter. Where are people better off, Sweden (GDP $635 billion) or India (GDP $3.2 trillion). Most would say Sweden. That is because, in Sweden, the annual per capita income is $61,000 compared to $2,250 in India.

The Real Economy vs The Money Economy

We need to identify the interests which push the growth agenda. The “business community” includes many types of enterprises with very different amounts of skin in the growth game.

- Farmers don’t need to produce 4% more food every year.

- Teachers don’t need to educate 5% more students or dentists fill 6% more cavities.

- Factories don’t need to produce 2% more widgets annually. (although most would like to)

Society benefits from wealth creation, not wealth transfer. And yes, the real economy does include productive, legitimate financial services. However, it does not include money printing or leveraging activities which produce no real wealth but rather transfer wealth from one group (us) to another (them).

The real economy doesn’t need growth. In fact in Canada, growth has been counter-progressive for decades in terms of personal well-being, equality levels, job quality, quality of life and fiscal and environmental balance.

Some groups would like the growth of the commercial economy to continue but few actually need it in order to survive or prosper. The few that are absolutely dependent on growth and its embedded inflation are the very players that the real economy can do very well without including:

- Cheap labour employers

- Speculators

- Banks printing inflationary debt

- Developers

It is important to recognize the difference between the growth of real output and inflated valuations.

Typically, inflation transfers wealth from productive middle and lower income people to wealthy, unproductive people and this process has driven the severe decline in equality levels in Canada over the past 5 decades. (from second most equal in the world early 1960s to the mid-30s now – this slide is unmatched)

Stable Market Demand does not mean a Stagnant Market

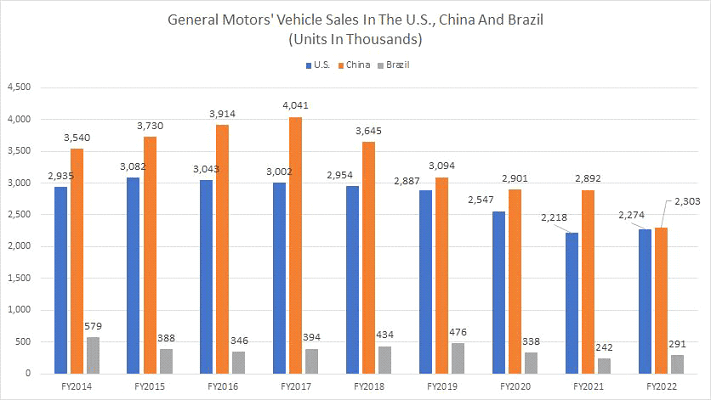

The graph below shows GM sales stabilizing but not disappearing. GM is still operating and developing new products and Mary Barra, GM’s CEO, made a total of $28,979,570 in 2022.

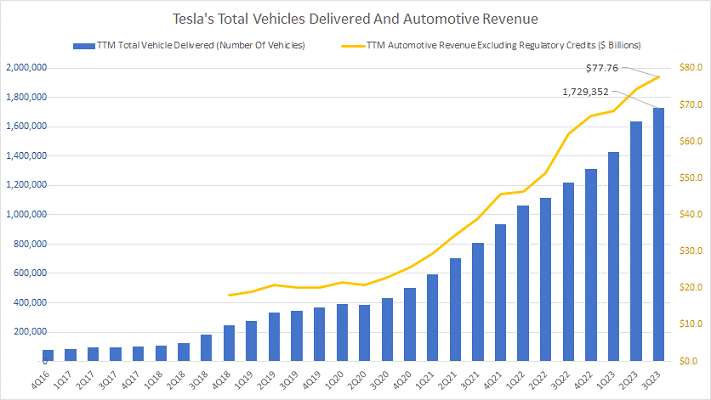

In a stable or declining market, disruptive and breakthrough companies like Tesla can still thrive and drive progress. Market dynamics will still continue to drive innovation in a post-growth market.

A stable population brings a shift in consumption, not an end to it. This new consumption pattern will likely be, and needs to be, far less energy and resource intensive.

Inflation: What proportion is real and how much is printed?

Inflation has many causes but we need to identify whether these are real or printed.

- Real inflation:

- Cost increase due to depleting resources, supply interruptions i.e. loss of efficiency.

- Monetary inflation:

- Demand driven price increases for real estate, stocks.

Real cost driven inflation can stem from:

- Depletion of resources.

- Declining EROIs are an ongoing source of real inflation.

- Supply chain interruptions cause real cost increases. Red Sea conflict, Covid

- Damage and mitigation costs of increasing extreme weather.

Repatriation of manufacturing initially looks more expensive because we will be paying the full environmental and social costs which are not included in most cheap labour/carbon intensive countries.

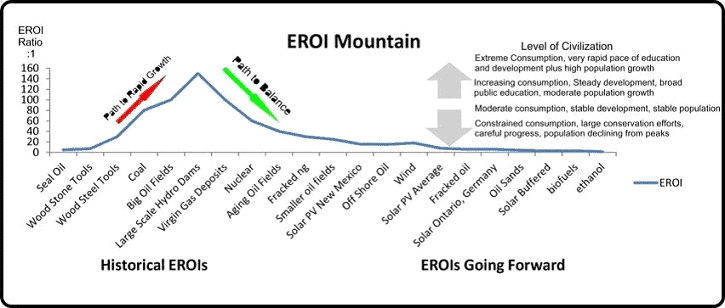

The EROI (Energy Returned on Energy Invested) mountain graphic below illustrates humanity’s passage from a brief era of increasingly cheaper and more abundant energy (rich virgin energy resources) to an era of depleting fossil fuel resources and more expensive renewable infrastructure substitutes.

Other resources are similarly declining but energy is the one that absolutely underpins the level of sophistication of our society.

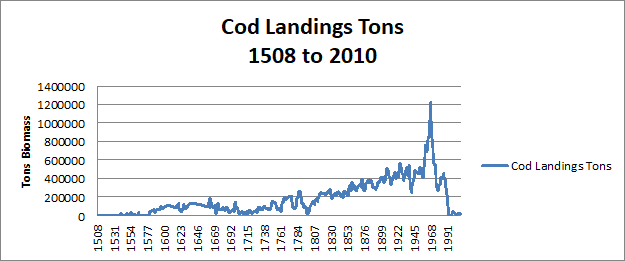

The classic resource crash of the Canadian cod fishery is illustrated in the graph below. Deplete the resource now and harvesting effort increases later while yields decline and perhaps never recover.

Printed Inflation:

Real estate inflation is The Great Scam. It is almost too big to see.

Scale of Profit Potential of the Asset Inflation Scam in $Billion (in Canada 2020)

Newspaper corporation revenue = $0.94

Defense Industrial revenue = $7.0

Tobacco Industry sales = $19.0

Oil and gas company gross revenue = $94.0

Residential housing asset inflation = $280.0 (valuation of $2.8 trillion 2020, with 10% inflation)

Inflation vs Real Cost Who Profits?

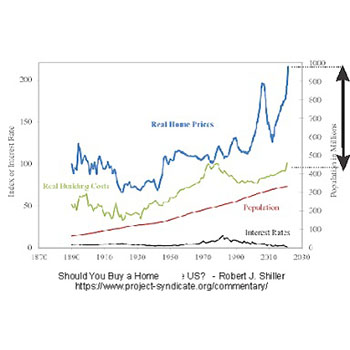

$ Trillions of Inflation enthusiastically has been coined ”asset enhancement”, “the wealth effect”, “asset appreciation” and other effusive terms by the finance industry and their media spokespeople Thank you Robert Shiller for putting real costs and inflated prices on the same page!

Money printing inflation contributes no real wealth yet the businesses which promote inflationary policies acquire huge amounts of real wealth.

We need to understand what the source of inflation is. The sticker price must be the full, all-in price in order for the commercial market to be environmentally and socially rational.

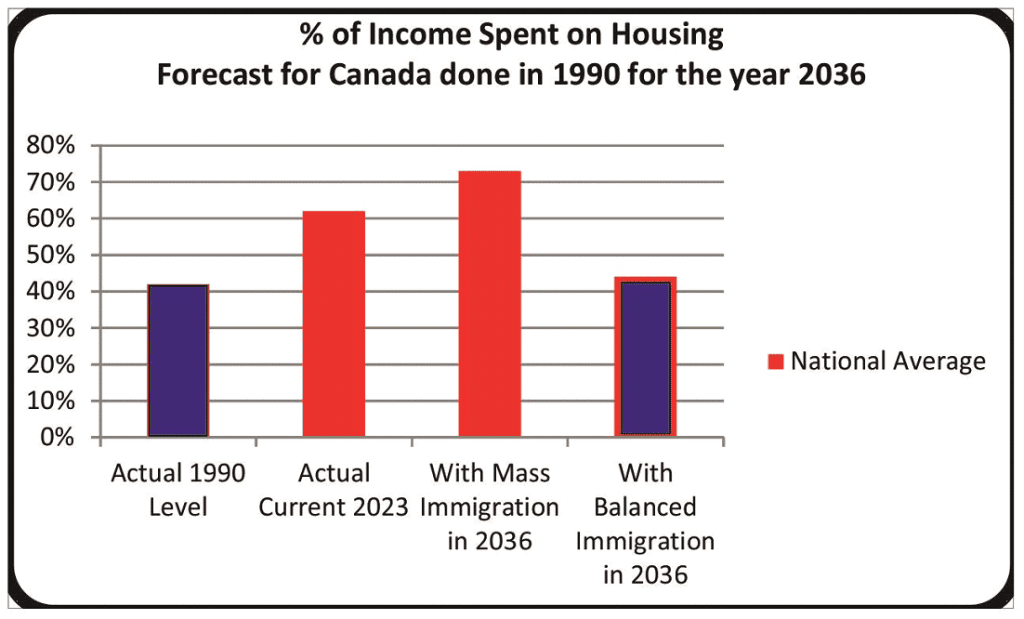

The graph on the left is what we predicted in the early 1990s. How does it look now?

How does this compare with claims over decades that mass immigration would reduce housing costs?

What Actually Happened and Who Profited?

A six times increase in mortgage debt illustrates the profit potential for banks, developers and speculators.

Their profit comes 100% from the pockets of working and productive Canadians.

Pumping up asset valuations and printing money on the basis of their increased market valuations is effectively counterfeiting.

Monetary inflation can be created and hidden a number of ways:

- Demand driven price increases for real estate, stocks.

- Trade deficit paid for in part by printed currency sent to foreign suppliers which then returns as money buying up domestic assets i.e. real estate, farmland etc.

- Basically you pay for the goods you receive with the goods you produce plus the assets you own. The seller gets paid whatever the method.

- Effectively, the consumer pays say $500 up front for a 60” LCD TV (what a deal!!) but the cost of their mortgages and rents goes up by maybe $15 a month forever as printed money to the producers comes back into the country as “foreign investment in real estate”.

- Would a fully informed consumer still make that deal if all of the cards were on the table?

GDP: Using a Tool designed to provide a basis for taxation for deciding national policy;

What could we possibly have missed?

- The creators of the national accounts system explicitly and emphatically stated that GDP/GNP should not be used for the formation of national policy.

- GDP is a cashflow metric, it does not deal with assets, well-being or environmental health

- It does not distinguish between productive activity and unproductive activity or between good and bad events.

The only people who promote GDP as a core metric are the ones profiting from cash flow and inflation.

See: Economics for Scientists https://sustainablesociety.com/316-economics-for-scientists/

Real Costs Allow Good Decisions to be made

Inflated valuations and hidden subsidies make bad decisions inevitable. We need to know the real costs of what we buy as consumers and the policies we enact as a nation. The sticker price has to be the full price. We need to look through the lens of the real economy.

This perspective of real money, real physical units and social and environmental context will provide us with what is needed:

- Non-inflationary Banking

- Public policy developed by the public

- Banks, developers and speculators stay out of public policy and media ownership

- Big pharma does not control public research

- Developers and cheap labour employers do not dictate immigration policy

- Fast food industry does not dictate children’s’ diets.

- Clear social metrics replace size of commercial economy metric (GDP)

- Strong and independent scientific review processes.

- Policies like immigration and oil sands are not allowed to evade environmental and social impact reviews

- The sources of inflation are broken down, clearly identified and scaled.

- All real costs are built into final costs.

The goal becomes not bigger but better with:

- High levels of equality

- High job quality and productivity

- Declining debt

- Stable housing costs.

- Declining environmental footprint

An End to Growth puts an end to Parasitic Business Models

An end to population growth will help deliver healthy, stable communities with affordable housing, minimal debt as well as higher per capita incomes and equality levels. It will reduce consumption.

In other words, this is a complete apocalypse for speculators, cheap labour employers, debt mongers and developers as well as politicians looking for fat campaign donations and post-public office contracts.

Many non-contributing business models will simply cease to exist.

Two Views of the Same Event;

Population stabilization and the end of growth

- End to cheap labour

- Higher productivity

- Higher job quality

- Higher wages

- Higher equality levels

- End to structural fiscal deficits

- End of demand driven real estate inflation

- Increased housing affordability

- Lower debt

- Higher equality levels

- Healthier communities

- Healthier families

- End of urban sprawl

- Loss of farmland and forests to housing ceases

- Improved food resiliency

- Higher quality of life

- Shorter commutes

- Improved access to nature

- End of increase in raw material consumption increases

- Carbon emissions plateau and then decline

- Resource depletion slows

- Real prices increase more slowly

- End of focus on growth

- Beginning of focus on sustainable progress

- Growth lobby control of national conversation is broken

- End of cheap labour

- Collapse of subsidized cheap labour business models

- Requires continuous investment in workers and processes

- Huge stress on centrally run franchise businesses which will have to pay living wages

- End of real estate inflation

- End of speculator and developer business models

- Reduction of political donations and post-office directorships

- Reduction of inflation derived income for lenders

- Money printing will take place solely in the stock market

- End of Urban Sprawl

- No new shopping mall developments

- Reduction in Raw Material Extraction

- End of focus on Growth

- Business models focused on getting better replace those focused on growth

- Investors must adjust to “slow money” i.e. lower real returns vs high returns on inflation driven projects.

The Course We Are Now On: Well defined by the Century Initiative

Humanity can have 1% annual population growth for 7 million years is a theory hatched by crackpot commercial economists 4 or 5 decades ago. On the physical plane of reality, humans would outnumber atoms (10 to the 85th power) in the universe after 25,000 years of 1% growth.

Commercial economics is a great business and tax tool but a poor and often suicidally bad tool for developing social and environmental policy.

We need a course change.

Scientists Need to Change Their Approach

Democracies are losing on almost all fronts, environmentally, socially and our democratic institutions are faltering. What is the worst possible environmental and social policy we could implement? Building a bigger version of what is already failing. This is exactly what we are doing. Pushing the Canadian population to 100 million is something to which 5 out of 6 Canadians are opposed.

Do you remember a single day in which the mainstream media did not call for growth? How do we change that?

Scientists and activists need to stop just providing information and making appeals to reason and start to identify the key promoters of the “The Great Inertia”; those actively countering the impact of scientific work.

This research paper deals with that exact issue:

Strength Out of Weakness: Rethinking Scientific Engagement with the Ecological Crisis as Strategic

Action by Sebastian Ureta, Javiera Barandiaran, Maite Salazar, Camila Torralbo as published in Elementa: Science of the Anthropocene, 25 September 2023.

Faced with the ecological crisis, environmental scientists are asking what else besides providing evidence they can do to steer needed processes of substantive change.

Putting a Face on the Growth Lobby

No people, in any country, would support the growth policy that has been implemented in Canada, the USA, Australia, the UK and some other nations. But the growth lobby has managed to hijack the decision making process and keep all metrics in the money-economy spectrum as social, biophysical or real economy indicators would completely expose their self-serving growth narrative.

Growth is still an unchallenged monologue in mainstream media (over which the growth lobby was careful to establish ownership). Experts and scientists need to provide the larger biophysical context necessary for a well-informed national conversation.

Our democracies need to be revitalized to make it easier for people to demand institutions do the job they were created to do.

- Environmental reviews

- Journalistic integrity

- Social responsibility

The media have a responsibility to give access to all well-informed opinions. (this assertion is likely to draw laughter in media boardrooms)

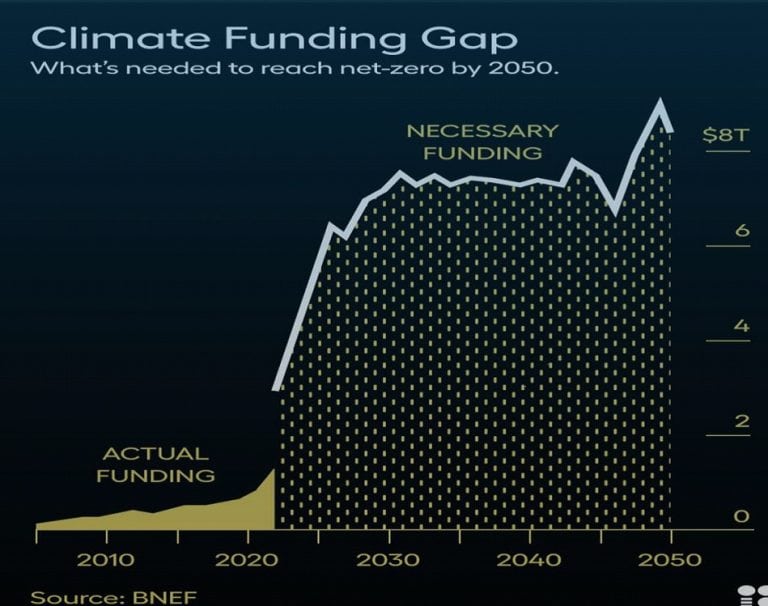

The Transition to Sustainability is not Currently Economically Viable

Full-cost pricing is needed to allow rational decisions to be made. Right now green initiatives are relatively Slow Money i.e. low return relative to development, debt and extraction. The current artificial structure of high returns on inflating assets and under-priced fossil fuels makes genuine progress investments look economically low grade with high risks and low and long returns.

In the world of money, saving the planet currently makes no economic sense.

The market, based on current energy prices and carbon prices, simply will not deliver a sufficient and timely response on its own. We need to illuminate the interests which oppose structural change in the market.

We need to make sustainability economically viable.

Pick Your Spots

- The commercial market is highly conflicted and full of false signals.

- Bank economists are criticizing immigration levels while the banks themselves finance Canada’s mass immigration lobby group the Century Initiative.

- Subsidizing cheap labour to support outdated business models, thus increasing government deficits, directly conflicts with most conservative business philosophy.

- What we see as chaos is actually a galaxy of conflicts, wrong assumptions and mistakes that deserve mention.

- It is tough to know where to start.

But for the numerate, real economy based commenter, public policy and media coverage are what can be referred to as a “target rich environment”.

Change of Plan - The Role of Scientists has to Expand

It is no longer enough for earth scientists to offer up ever more alarming studies and for activists to repeat the message that we need to somehow act to avoid a losing showdown with Mother Earth.

We need to make social policy biophysically coherent and separate from the commercial economy.

We need to identify the interests which are slow-walking and derailing the transition to a de-carbonized and sustainable society.

Democracy and informed conversation are failing and they won’t fix themselves.

Push the media into a new zone by forcing them to consider new metrics and policy alternatives. Demonstrate that they have failed in their public service responsibilities. They will never connect the dots if scientists in small groups don’t hold their noses to the mess they have made.