As someone who operates a business, you are very familiar with the well-honed financial tools you use to measure and monitor its health and operation. These monetary tools have been developed over many centuries to illuminate the inner workings of an entity whose sole purpose is to take in more money than it expends.

Assets, sales revenue, expenses, profits and losses are measured in great detail by the suite of financials which include:

- Cash flow

- Profit and loss

- Income statement

- Balance sheet

These outline financial performance over a specific period of time which indicates the trend in business efficiency and profitability. A costing system is more or less a real-time representation of the production process and optimizes the fine-tuning of the production process and investment decisions.

With a few caveats, these measurement instruments provide real operational insight into the complete workings of the business and are all the analysis tools necessary to assure its long term survival. That is because the lifeblood, assets, output and goals of the business are all measured in dollars.

The world of economics is different

The primary tool of the economics world is Gross Domestic Product. GDP captures the value of all the goods and services in a society that have been exchanged for money. It sounds similar to the financial tools used for a specific business but beyond the use of dollars as the medium of exchange, the similarity stops.

The GDP system of national accounts was created to monitor the commercial economy so that an equitable tax system could be established. Its creators, Simon Kuznets was the foremost US contributor, warned specifically and emphatically that the GDP metric should not be used as a measure of economic or social health or used as a tool for national policy development.

The welfare of a nation can scarcely be inferred from a measurement of national income asdefined by the GDP.

Simon Kuznets

Being a cash flow metric, GDP can’t distinguish between productive and unproductive efforts. It doesn’t flag any change in social assets, much less environmental ones. Disasters such as hurricanes show up as

positives due to all of the paid work they generate, with no accounting for the destruction of public and private assets they involve. Ditto small wars, cancer and traffic accidents, etc., etc.

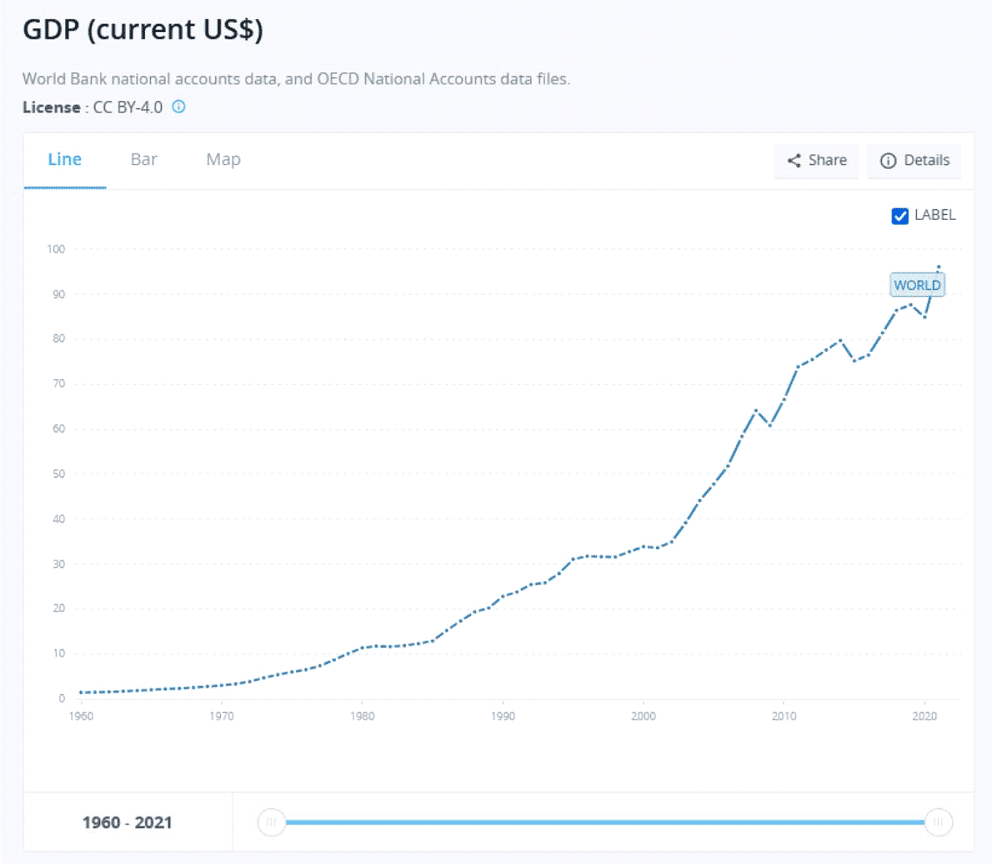

These events are all “good for the economy” according to the GDP metric which also provides no warning that problems may lie ahead. How would one possibly infer from the graph below that we are now into an era of climate disruption and resource depletion?

Climate, resources, inequality, wars, plummeting fertility rates, debt, deficits; no problem here! The economy is doing great.

It is wonderful to have a high-functioning commercial economy but we need to understand that it is but a small portion of the social and environmental infrastructure that allows humans to maintain sophisticated societies.

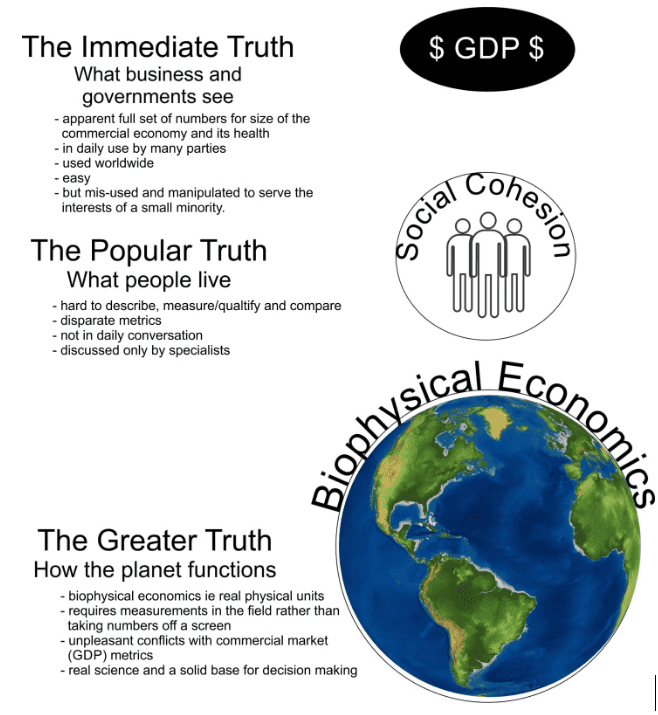

The commercial economy is a subset of human society which is a subset of the natural world.

Seeing the complete picture

The biophysical world in which we live is far more complex and extensive than the GDP metric can possibly represent. Biophysical economics – the study of the physical flows and energy within our biosphere – can guide national policy in a way that commercial economics is simply incapable of.

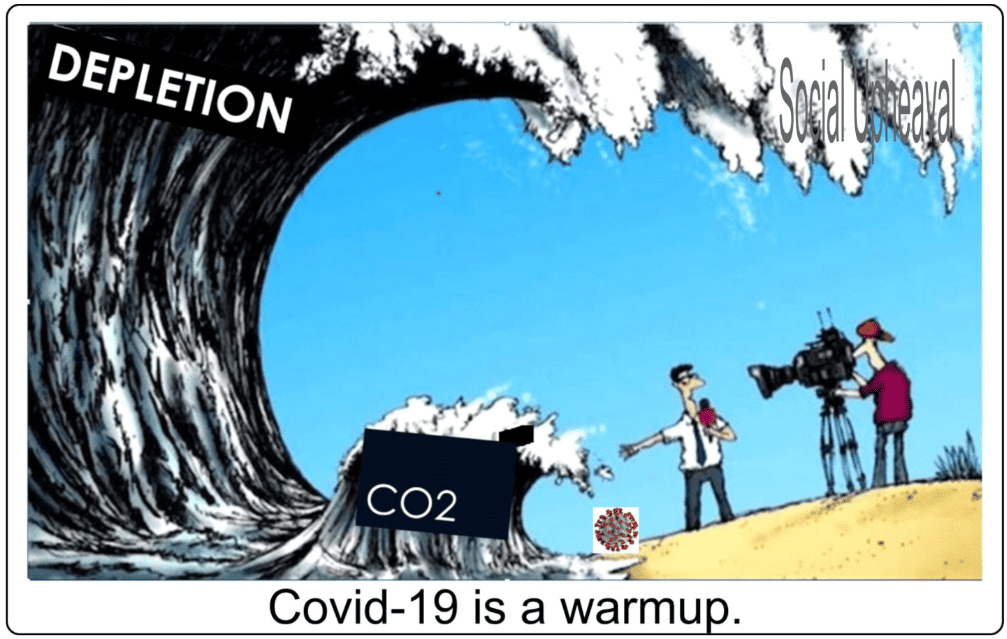

Our attention is focused on the most immediate and obvious issues such as Covid and climate change.

GDP clearly is very limited in the scope of the information it provides. There is nothing wrong with this as it does the job it was designed to do – monitoring activity in the commercial economy – very well. It is our wide-spread acceptance that GDP is an all-knowing God that is the problem.

For the most part GDP is an excellent tool. However, there is one glaring flaw in the GDP metric and it is a very serious one. In not distinguishing between productive and unproductive effort, it allows monetary Ponzi schemes to thrive. It allows the printing of money and the inflation of asset valuations, principally real estate and stock valuations, to pass as productive economic endeavours when, in reality, they are a tax on the productive by the unproductive.

These schemes divert attention away from the real, productive economy and focus attention on the unproductive pastimes of stock trading and housing speculation. Do you see many ads in the corporate media promoting manufacturing or service startup opportunities? Compare this to the number of day trading, real estate courses and crypto ads.

They are all get-rich-quick schemes that produce no real goods. They are zero-sum and any profits the participants may enjoy comes out of someone else’s pocket.

A metric that measures progress in the amount of dollars turned and the number of building cranes in a city won’t illuminate the path to sustainability.

Picking the Right Tool

It is critical that policymakers base their decisions on the best information and use the best tools to execute those decisions. As a scientist, you have proven, well-grounded tools at your disposal. But as a citizen, you need to be aware that the current tools used to guide our country are completely inadequate and actually quite dangerously misleading.

We need the foresight and complete accounting that biophysical economics and social well-being indicators can contribute to national policy. Flows of printed currency simply don’t cut it.

John Meyer